What Defined 2025 and What’s Coming in 2026: Big Shifts in Real Estate 🏡📈

The real estate market in 2025 did not implode, but it also did not boom. Instead, as discussed in a recent episode ofThe Real Estate Show with Pat Lopez, the year was defined by commission lawsuits, rapid industry consolidation, and one overlooked factor that may drive 2026: how long mortgage rates stay in a manageable range.

Prefer to watch instead of read?

🎧 Watch the full breakdown on YouTube:2025 Real Estate Recap & 2026 Predictions – The Real Estate Show with Pat Lopez

Did the Burnett Lawsuit Really Change Real Estate Commissions?

Short answer: not the way most people expected. The Burnett class‑action lawsuit and related settlements added up to well over a billion dollars in exposure and headlines, but they did not cause commissions to collapse for most agents.

What actually changed wast ransparencyand structure:

Buyer’s agent compensation is now negotiated and documented upfront.

Buyers better understand how and when their agents are paid.

If sellers will not cover the full amount, buyers can choose to make up the difference as part of the deal.

Consumers still want professionals, transactions remain complex, and most people do not want to DIY pricing, negotiations, showings, and contracts, so the core value of skilled agents remains intact.

Key takeaway:

👉 The lawsuit did not weaken agents; it forced better communication, clearer written agreements, and stronger value positioning..

Why Is the Real Estate Industry Consolidating So Fast?

Another defining trend of 2025 was major consolidation among real estate and mortgage platforms. Rocket Companies announced a multibillion‑dollar deal to acquire Redfin, and Compass moved to acquire Anywhere, the parent company of brands like Coldwell Banker and Century 21.

If these deals fully close and integrate by 2026, Compass and Rocket‑Redfin together could control a significant share of brokerage, portal, and mortgage traffic, accelerating the shift toward fewer but larger players.

What this means for agents and consumers:

Bigger brands with more data, marketing reach, and technology.

Increased competition for top talent and teams as large firms recruit aggressively.

Fewer mid‑sized independent brokerages able to survive between boutique and mega‑platform models.

Key takeaway:

👉 Consolidation is not a maybe—it is already underway, and 2026 will likely accelerate it as companies chase scale and efficiency

This is the big one — and the answer hinges on interest rate duration, not just rate drops.

2025 by the numbers:

2024: ~4.0 million transactions

2025: ~4.1 million transactions

That extra 100,000 transactions equals 200,000 more sides, which is meaningful — but not explosive growth.

The problem? Rates dropped briefly… then shot right back up. Buyers and sellers never had enough time to act confidently.

What could change in 2026:

Rates holding in the high 5s to low 6s

Stability lasting 3–6 months, not days

Stronger spring and summer markets

Pat believes that if rates stay under ~6.5% for a sustained period, transactions could rise to 4.3 million — a solid improvement over 2025.

What about 50-year mortgages?

Don’t expect a revolution. Pat sees them as:

A niche product

Similar to 15-year loans

Rarely chosen compared to the 30-year fixed

Will 2026 Be a Better Year for Buyers and Sellers?

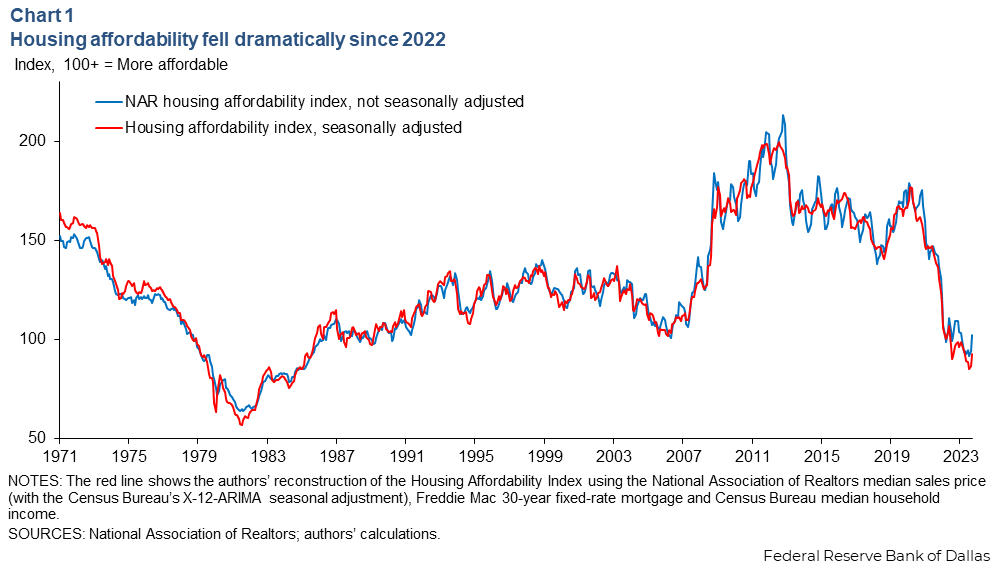

This is the big question, and the answer hinges oninterest rate duration, not just rate drops. Existing‑home sales hovered around 4.0 million in 2024 and roughly 4.1 million in 2025, adding only about 100,000 transactions—or 200,000 sides—which is meaningful but far from a full rebound.

In 2025, rates dipped briefly before jumping back up, which did not give buyers or sellers enoughtimeto act with confidence. What could change in 2026, if forecasts hold:

Mortgage rates stabilizing in the high‑5% to low‑6% range.

Stability lasting 3–6 months instead of a few volatile weeks.

A stronger spring and summer market as pent‑up demand finally has a window to move.

Pat believes that if rates can stay under roughly 6.5% for a sustained period, total transactions could climb toward 4.3 million, which lines up with outside forecasts calling for a moderate sales increase rather than a 2021‑style boom.

What about 50-year mortgages?

Do not expect them to transform the market: they are more likely to be a niche product, similar to how 15‑year loans appeal to a small share of borrowers compared with the 30‑year fixed.

Key takeaway:

👉 The magic word for 2026 isduration—stable, predictable rates matter more than dramatic one‑week drops.

Final Thoughts: Why 2026 Could Outperform 2025

No one has a crystal ball, but if affordability improves at the margins and interest rates hold steady instead of whipsawing, 2026 has real upside for agents, buyers, sellers, and investors.

That kind of environment can mean:

More confidence and clearer planning horizons.

More listings as would‑be sellers finally feel ready to move.

More buyer activity and a healthier level of completed transactions.

If you are in the business, now is the time to prepare your 2026 playbook around realistic commission structures, big‑brand consolidation, and the power of stable interest rates—not to panic about a crash that has not shown up in the data.

👉Watch the full episode on YouTube:2025 Real Estate Recap & 2026 Predictions – The Real Estate Show with Pat Lopez.

[00:00] Intro & 2025 Overview

What happened in real estate in 2025 and what Pat will cover for 2026.

[00:30] Burnett Lawsuit Fallout

Why the class action mostly paid attorneys and did not crush commissions.

[01:10] New Commission Reality

Buyer‑agent value, upfront compensation talks, and slightly higher fees.

[02:05] 2025 Consolidation Wave

Rocket–Redfin, Compass–Anywhere, and the push toward bigger platforms.

[03:20] Sales Volume: 4.0M → 4.1M

What the extra 100k transactions (200k sides) really means.

[04:00] 2026 Outlook: Rates & Duration

Why stable sub‑6.5% rates for 3–6 months could push sales toward 4.3M.

[05:10] 50‑Year Mortgages = Niche

Why 30‑year fixed stays dominant despite policy talk.

[05:45] Final Take & CTA

Key ingredients for a better 2026 and Pat’s ask to comment, subscribe, and follow the show.